ESG Due Diligence: Driving Value Creation in Private Markets

25 November 2025

Authors

Lauren Wye

Associate DirectorLauren@orbisadvisory.comLena Sassenfeld

Senior ConsultantLena@orbisadvisory.comAcross private markets, embedding ESG into business operations is proving to be a measurable driver of financial performance. For example, the PRI estimates that portfolio companies that effectively integrate sustainability during the holding period can increase their valuation multiple at exit by 6-7% [1]. As such, ESG considerations are increasingly forming part of the private equity investment lifecycle, from pre-deal due diligence to value creation planning to exit due diligence.

In private equity, due diligence has traditionally focused on assessing commercial, financial, and legal fundamentals to identify risks and validate a target’s value. Increasingly, however, investors are expanding this process to include evaluations of a company’s ESG performance to uncover both hidden risks and untapped opportunities.

It is clear ESG is no longer just a checkbox exercise – it is a core part of the investment analysis and a key lever for pricing, multiple growth, and the overall attractiveness of a portfolio company at exit.

The Evolution from Risk to Value Creation

Originally, ESG metrics in private equity were treated as a compliance or screening exercise, with a focus on risk mitigation. The objective was ensuring no major incidents and avoiding reputational and regulatory shocks, often by screening out controversial sectors. But increasingly the narrative is shifting: ESG is no longer just about avoiding potential costs but creating opportunities and aligning with investor demands. In response to a changing market, sustainable business practices have emerged as a powerful driver of value creation, with strong ESG credentials translating into tangible benefits at exit.

Where Is Value Created?

As the financial upside of ESG becomes increasingly recognised, PE firms are sharpening their focus on its value creation potential. PwC’s Global Private Equity Responsible Investment research found that 70% of PE firms rank value creation as one of the top three drivers for their ESG activities [2]. In practice, this value tends to emerge through four main channels:

Revenue Uplift: Strong ESG performance enhances brand credibility, supports value-based pricing, and opens new market segments. The PRI estimates sustainable consumer goods can result in an up to 28% price premium and achieve 55% faster market share growth [3].

Cost Efficiency: ESG initiatives deliver tangible cost savings and margin resilience. The PRI estimates 6% cost reductions through waste reduction and improvements in energy efficiency and other operational processes [4]. These levers strengthen EBITDA and reduce operational volatility.

Cost of Capital: ESG performance can be monetised through preferential financing, improving capital access. Sustainability-linked loans (SLLs) and ESG-margin ratchets can provide lower borrowing costs tied to ESG KPIs, reducing the cost of debt and enhancing liquidity. In private credit deals, step-downs can reach up to 40 basis points when targets are met [5].

Risk Management and Supply Chain Resilience: Embedding sustainability considerations into procurement and operations enhances supply chain resilience and cost stability. Transparent supplier engagement, emissions tracking, and ethical sourcing reduce exposure to price volatility and regulatory risk, resulting in more stable cash flows, margins, and improved valuations [6].

What Does ESG DD Look Like in Practice

By integrating ESG into both pre-deal evaluation and post-deal ownership practices, PE firms can maximise ESG value creation opportunities across the entire investment lifecycle.

Pre-Deal ESG Due Diligence:

Before investment, ESG DD assesses material risks, opportunities, and data quality to inform investment decisions and deal structuring. Key activities include:

Post-Deal ESG Due Diligence:

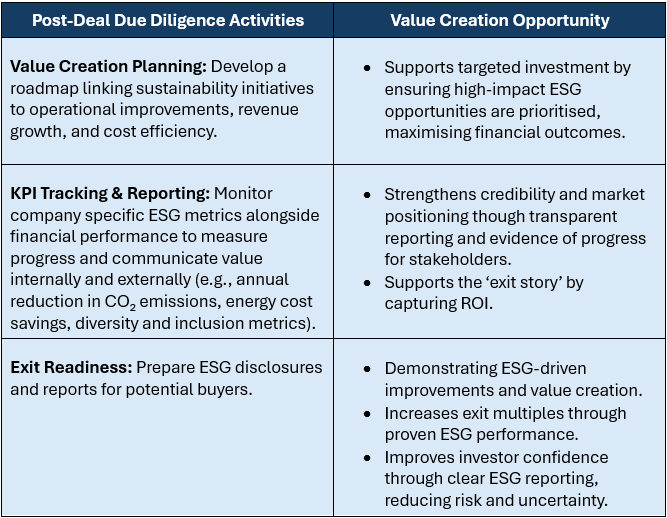

Once a portfolio company is acquired, ESG DD shifts from assessment to implementation and performance monitoring, leveraging ESG for value creation. This includes:

By embedding ESG into both pre- and post-deal processes, PE firms can protect value, drive operational improvements, and position portfolio companies for stronger exit outcomes.

How Orbis Advisory Can Help

Our Sustainable Finance solution provides end-to-end ESG and deal advisory services tailored to private equity firms. We help evaluate ESG risks and opportunities across the investment lifecycle, from pre-deal due diligence to post-deal value creation and exit readiness. This includes:

Pre-Deal ESG Due Diligence: Identify ESG risks and opportunities that can drive margin expansion, revenue growth, and operational efficiencies, feeding directly into investment decisions and deal structuring.

Post-Deal/Onboarding Due Diligence: Establish an ESG performance baseline and set KPIs and targets to be monitored during ownership. We can also support the creation of 100-day plans.

Exit Due Diligence: Evaluate portfolio companies’ ESG performance against KPIs, future ESG opportunities, and prepare robust reporting to demonstrate ESG-driven value creation to potential buyers, supporting higher exit multiples.

Portfolio Company Support: Provide actionable recommendations for embedding ESG improvements that enhance operational resilience, cost savings, and long-term financial performance.

By integrating ESG into both investment decisions and portfolio management, Orbis Advisory helps PE firms mitigate risk, enhance returns, and maximise exit value through credible sustainability practices.

Orbis Advisory also publishes a bi-annual PE ESG Transparency Index highlighting key ESG priorities, emerging practices, and industry leaders across the PE landscape. Insights from this index also help ensure that our Sustainable Finance solution and ESG DD offering remains competitive and aligned with evolving market expectations.

For more information on Orbis Advisory, visit our Sustainable Finance page, or contact us directly.

Citations:

UN PRI Sustainability Value Creation Report 2025

PWC Global Private Equity Responsible Investment Survey 2023

UN PRI Sustainability Value Creation Report 2025

UN PRI Sustainability Value Creation Report 2025

New Private Markets: Why sustainability-linked loans should be a talking point (October 2025)

UN PRI Sustainability Value Creation Report 2025

More Resources:

Janson, Eric, et al. 2023. “Generating Upside from ESG: Opportunities for Private Equity.” https://www.pwc.com/gx/en/sustainability/assets/pwc-private-equity-responsible-investment-survey-2023.pdf.

Mitchenall, Toby. 2025. “Why Sustainability-Linked Loans Should Be a Talking Point.” New Private Markets. October 23, 2025. https://www.newprivatemarkets.com/why-sustainability-linked-loans-should-be-a-talking-point/.

Richards, Claire, & Johnson, Paige. 2025. “How ESG Drives Value Creation | Anthesis Group.” Anthesis. September 5, 2025. https://www.anthesisgroup.com/insights/esg-value-creation-private-equity/#revenue.

Vikram, Aditya, et al. 2025. “Sustainability Value Creation: A Framework for Driving Financial Value through Sustainability in Private Markets.” Unpri.org. UN PRI. https://public.unpri.org/download?ac=23800.